The improbable Trump presidential win has led to the most obvious of questions, which is – what can Trump do for the economy?

To answer that, let’s take a look at what’s left of the economy after 8 years of Barry’s version of “economics”, which seemed to largely consist of increased federal spending (to new record levels), massive increases in the regulatory state, and condemnation of those who pay over half the income taxes the federal gov’t seems to so happily gobble up.

It turns out that federal spending and the growth of the federal government does not increase GDP, even when federal outlays are a component of the GDP metric. The spike in spending in 2008 (these are YOY percentage changes) and again in 2010 reinforce that conclusion – even if you assumed a causal relationship between spending in 2008 and the return from negative GDP in 2008/2009/2010, that conclusion becomes demonstrably false after 2010’s spending, which almost matches 2008, and GDP for that year is flat and decreases afterwards.

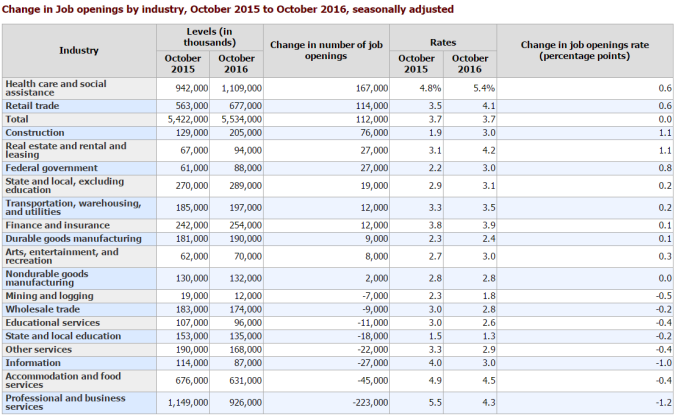

There’s virtually zero correlation to federal spending and economic growth, especially in this “recovery” as it pertains to job growth. As an example, let’s look at YOY job growth by job category, October 2015 to October 2016 (from our friends at BLS.gov):

Health care and social assistance are largely funded by tax dollars – Medicare and Medicaid are an enormous component all health care spending, so the jobs “created” in health care, are, in part, funded by taxes. Pensions, in the category below, includes Social Security, disability insurance, workers compensation, etc. Health care in the category below, includes Medicaid, Medicare, and everything in between. Over half the 2016 federal budget – $3.854 trillion – is consumed in these two categories.

So while federal spending in the largest job-creating categories means that, well, we’re borrowing 40% or so of every dollar spent to create jobs in areas that are already funded by tax dollars, means we’re chasing a negative feedback loop if we think federal spending can simply fund an infinite amount of jobs, and/or increase incomes.

In fact, if you take a look at federal expenditures and median household incomes, there’s almost an inverse impact on incomes – federal spending goes up and median household incomes stay the same, or actually decrease. When spending goes down, in 2013-2014, incomes actually go up. Which should tell you all you need to know about using federal spending to increase incomes.

So, despite 8 years of the 2009 Recovery Summer, what were Obama’s results after assuring us that we needed to spend trillions we didn’t have, else the economy would crash? A fairly wrecked economy that’s stumbled forward for 8 years – 8 years! – with incomes staying fairly flat, and frequently dipping into negative growth rates.

As Fortune points out in a recent article, it can be argued that for the first time in modern history, there has been no economy recovery. At least according a Gallup study (linked from the Fortune article), titled “An Analysis of Long-Term US Productivity Decline“:

Rothwell (the study’s author – ed.) goes on to argue that regulatory and tax reform is the main culprit for America’s economic woes, and that the healthcare, housing, and education industries have been particularly harmed by the government. He points to statistics showing that despite rapidly rising costs in all three of these industries, the quality of the products and services offered has stagnated.

Growth in government spending just exacerbates the negative trends. As an example, new firms per capita are half of what they were in 1981 – and new firms, and new jobs, are the engines that drive future business growth. From page 73 of the study:

ENTREPRENEURIAL ACTIVITY HAS DECLINED

The escalating cost of healthcare may also have implications for the creation of new firms or startups. There is always an element of risk in creating a new business, but the rising costs of healthcare magnify that risk. In previous decades, an employed worker could quit his or her job and pay for healthcare expenses out-of-pocket if necessary. Now, out-of-pocket expenses for the non-insured are extremely high, so an employed worker who quits to start a business likely gives up a valuable healthcare plan and may have to impose those costs on his or her own fledgling business at a time when revenue is dangerously low. Provisions in the Affordable Care Act were designed to make it easier for the self-employed to purchase health insurance, but even in 2014, 23% of self-employed workers between the ages of 18 and 64 lacked health insurance, compared with 13% of wage and salary workers. For those who are self-employed and have insurance, only about half get it through their businesses.93 Whatever the reasons, people are much less likely to either be self employed or start firms with at least one employee. The number of new firms with at least one worker per capita has fallen by about half since the late 1970s. Although the downward trend has been going on for decades, it accelerated over the Great Recession and has not inched back up.

If the United States is to recover from Obama’s Recovery Decade ™, a good place to start would be the dismantling of federal spending on a permanent basis, and a re-set in Congress in terms of what it can and should be doing to foster economic growth. Instead of a decade of piling on regulations and costs in a recession, maybe it could start lifting those weights off of businesses’ backs, and see what happens.

a permanent basis, and a re-set in Congress in terms of what it can and should be doing to foster economic growth. Instead of a decade of piling on regulations and costs in a recession, maybe it could start lifting those weights off of businesses’ backs, and see what happens.

Because whatever Obama’s been trying for 8 years is a perfect recipe for keeping the economy, and the people who do all the work in it, permanently in the ditch.

I feel like taking an economics class prior to being president should be a requirement. Or perhaps some tutoring on weekends. It would have made a huge difference if Obama understood some simple concepts and used those to guide policy. This is especially true when it comes to the effects of confidence (recall Jan 2009 in his first speech as president he said “this is far far worse than i ever expected), leadership (same speech and many subsequent where he spent energy blaming people rather than focusing on fixing things, in addition to the points made above, in the well-written piece.

LikeLike